Free Debt Advice & Consolidation Options

Struggling with debt in South Auckland? Get free debt advice and explore consolidation options. Our guide offers practical steps, local resources, and expert insights to help you regain financial control. Start your journey to a debt-free future today!

mangerebudgeting.org.nz

What You Will Learn

Struggling with debt in South Auckland? Get free debt advice and explore consolidation options. Our guide offers practical steps, local resources, and expert insights to help you regain financial control. Start your journey to a debt-free future today!

Finding yourself weighed down by debt can feel overwhelming, especially in a vibrant community like South Auckland. The good news is, you don’t have to face it alone. There are numerous resources and pathways available to help you navigate financial challenges, offering not just hope but practical, actionable solutions. This comprehensive guide will walk you through where to find free debt advice in South Auckland, explore various consolidation options, and empower you with strategies to regain control of your financial future.

Our aim is to provide clear, authoritative, and approachable insights into managing debt effectively, ensuring you have the knowledge and tools to make informed decisions. Whether you’re considering a debt consolidation loan, need help negotiating with creditors, or are simply looking for a supportive financial mentor, this article is designed to be your first step towards financial freedom.

Table of Contents

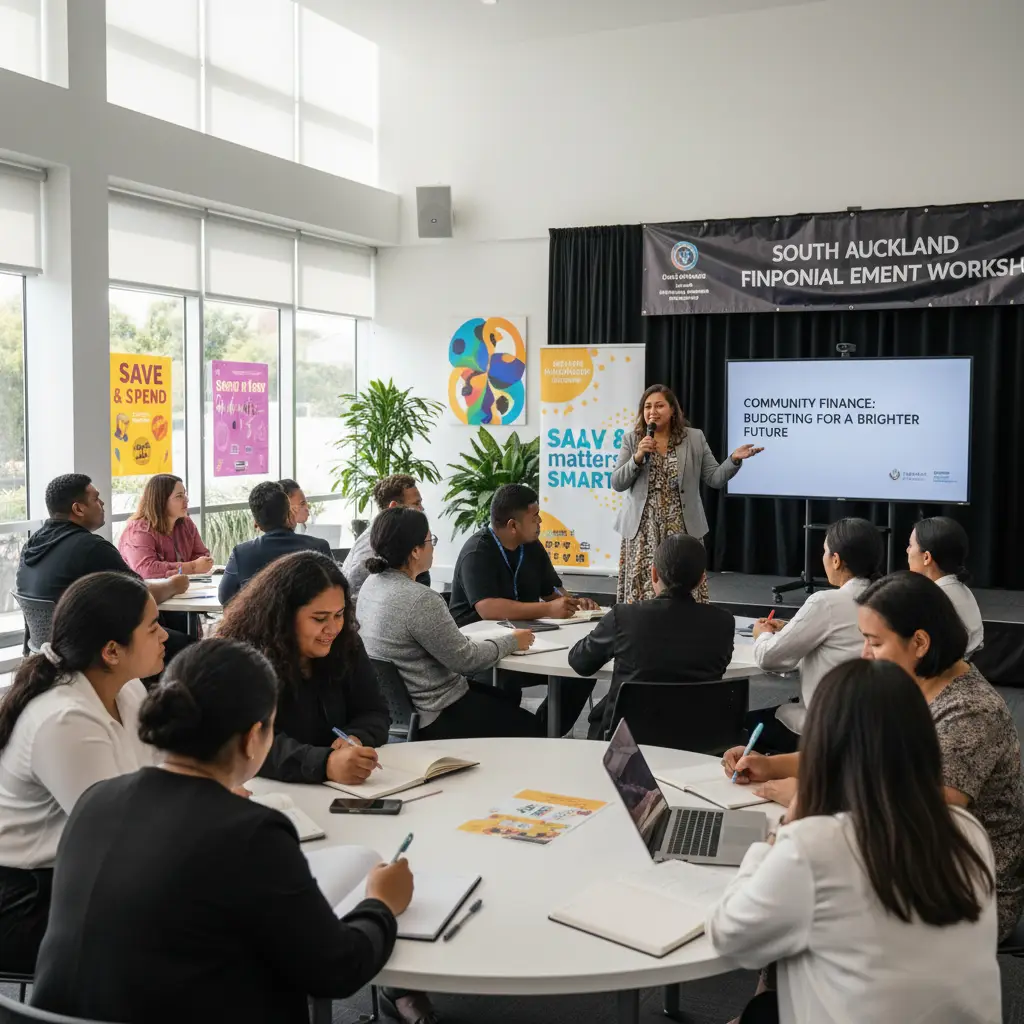

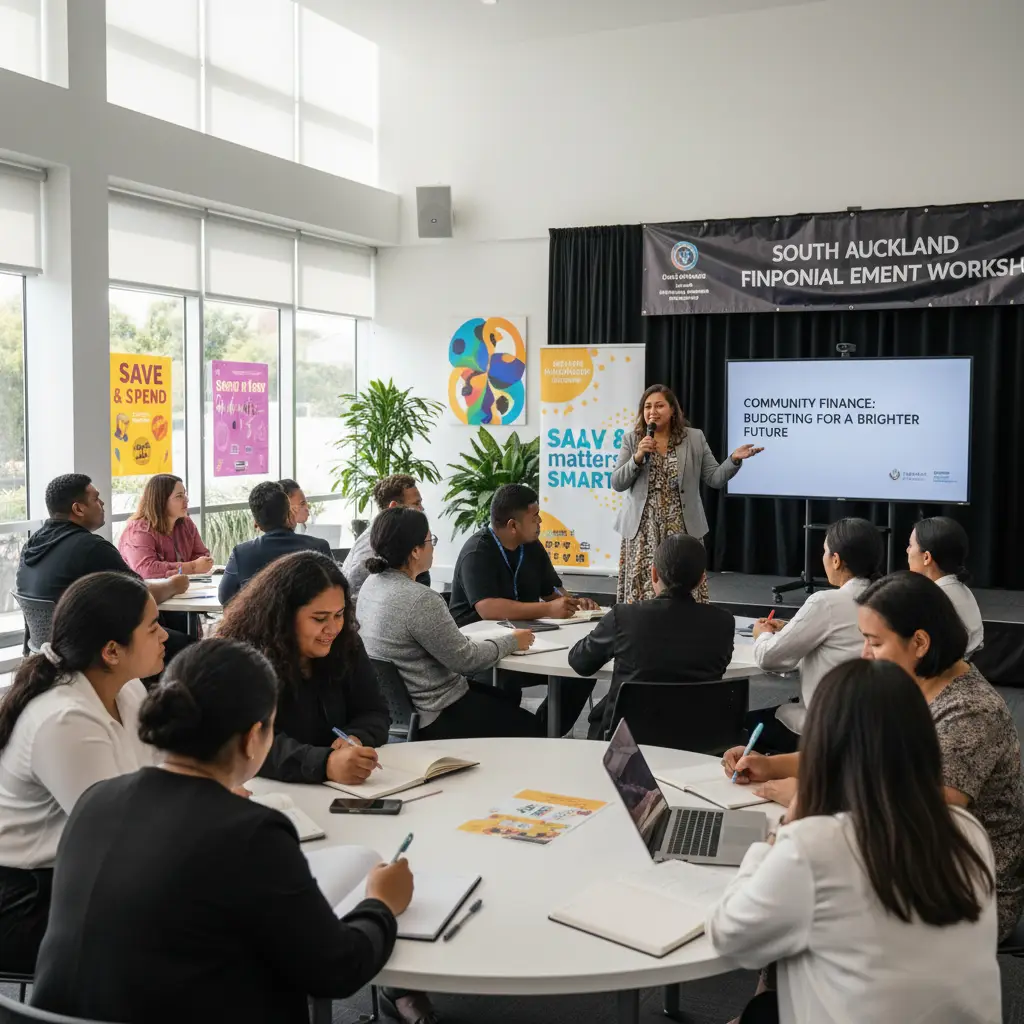

Where to Find Free Financial Mentors

One of the most effective first steps when dealing with debt is to seek guidance from a qualified financial mentor. These professionals offer confidential, non-judgmental free debt advice in South Auckland and across New Zealand. They can help you understand your financial situation, create a budget, and explore viable solutions without any cost to you.

Community-based services play a crucial role in providing accessible financial literacy. Here are some avenues to explore:

- Budgeting and Family Support Services: Many local community centers and churches in South Auckland offer free budgeting advice. These services are often run by trained financial mentors who can help you develop a realistic budget, understand your debt, and connect you with other support services. Look for services accredited by FinCap (formerly the National Building Financial Capability Charitable Trust).

- Citizens Advice Bureau (CAB): While not solely focused on finance, CAB offers a wide range of free information and advice on various topics, including debt and consumer rights. They can signpost you to specialized financial mentoring services in your area.

- Online Resources: Websites like Sorted.org.nz, a free service from the Commission for Financial Capability, provide excellent tools, guides, and articles on managing money, debt, and planning for the future. While not a direct mentor, it’s a valuable self-help resource.

- Local Iwi and Pacific Island Community Groups: Many cultural organizations in South Auckland offer specific financial literacy programs tailored to their community members, often with a culturally appropriate approach. Inquire within your local iwi or community trust.

Remember, these services are designed to empower you. Don’t hesitate to reach out. They are there to help you identify the best path forward.

Understanding Debt Consolidation Loans

Debt consolidation is a strategy that involves taking out a new loan to pay off multiple existing debts. The goal is to simplify your payments into one monthly installment, often with a lower interest rate than what you were paying on your individual debts. This can make debt management feel less daunting and potentially reduce your overall cost of borrowing.

“Debt consolidation can be a powerful tool for simplifying finances, but it’s crucial to understand its mechanics and ensure it aligns with your long-term financial goals.”

How Debt Consolidation Works

When you consolidate, you typically apply for a new loan – either secured (e.g., against your home or car) or unsecured (no collateral required). If approved, the funds from this new loan are used to pay off your existing credit card balances, personal loans, or other debts. You then make a single, regular payment to the new lender.

Pros and Cons

- Pros: Simplified payments, potentially lower interest rates, reduced stress, and a clear path to becoming debt-free.

- Cons: If you don’t address the underlying spending habits, you could accumulate more debt. Some loans come with fees, and extending the repayment period might mean paying more interest over time, even with a lower rate. Secured loans put your assets at risk.

It’s vital to shop around for the best terms and to ensure the new loan genuinely offers a better deal. Always compare interest rates, fees, and repayment periods. Free financial mentors in South Auckland can help you evaluate if debt consolidation is the right step for your specific situation.

Is Bankruptcy an Option?

For some, debt can become so overwhelming that traditional repayment methods are no longer feasible. In such extreme cases, bankruptcy might appear as a potential solution. However, bankruptcy in New Zealand, known as “No Asset Procedure” (NAP) or “Bankruptcy” itself, is a serious legal process with significant long-term consequences. It should always be considered a last resort after exploring all other options, and only with professional legal or financial advice.

Understanding the No Asset Procedure (NAP)

The NAP is designed for people who have minimal assets and debts between $1,000 and $50,000. If you qualify, your debts are effectively written off, and you are released from them after a year. However, it will impact your credit rating for several years, and certain types of debt (like student loans or fines) are not covered. You also cannot be a director of a company during this period.

Bankruptcy Proper

If your debts exceed $50,000 or you have significant assets, you might be declared bankrupt. This involves an Official Assignee taking control of your assets (except for essential household items and tools of trade) to sell them and repay creditors. Bankruptcy typically lasts for three years and has severe implications for your financial reputation, employment, and ability to obtain credit in the future.

Before considering bankruptcy, it is imperative to seek free debt advice in South Auckland from financial mentors or legal aid services. They can help you understand all the implications, explore alternatives like debt repayment orders, and ensure you make the best decision for your unique circumstances.

Negotiating with Creditors

Many people are surprised to learn that creditors are often willing to negotiate. They would typically prefer to receive some payment rather than nothing at all. Approaching your creditors proactively and respectfully can lead to more manageable repayment terms. This is a crucial area where good free debt advice in South Auckland can make a significant difference.

1. Gather Your Information

Before contacting any creditor, collect all relevant details: account numbers, current balances, interest rates, and your current financial situation (income, expenses, and what you realistically can afford to pay).

2. Be Proactive and Honest

Contact your creditors as soon as you anticipate or experience difficulty. Explain your situation honestly. Creditors are more likely to be helpful if you communicate openly.

3. Propose a Realistic Plan

Based on your budget (which we’ll discuss next), propose a payment plan you can genuinely stick to. This might involve:

- Lowering Monthly Payments: Ask if they can reduce your minimum payment.

- Temporarily Halting Payments: In extreme cases, a temporary payment holiday might be an option.

- Reducing Interest Rates: Inquire about hardship rates or interest freezes.

- Settling for Less: If you can make a lump-sum payment, sometimes creditors will accept a lower amount to close the account.

Your Creditor Negotiation Checklist:

- Document Everything: Keep a record of who you spoke to, when, and what was agreed upon. Follow up verbal agreements in writing (email is fine).

- Stay Calm and Respectful: Maintain a professional demeanor, even if you’re feeling stressed.

- Don’t Promise What You Can’t Deliver: Only agree to payment terms you know you can meet.

- Seek Support: A financial mentor can often negotiate on your behalf or provide invaluable coaching.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is the backbone of regaining financial control. It’s a roadmap that outlines how you will pay off your debts systematically. This is where free debt advice in South Auckland truly shines, as mentors can help you build a personalised, achievable plan.

1. Assess Your Financial Reality

The first step is to get a clear picture of your income and all your expenses. List every single debt you have: credit cards, personal loans, car loans, hire purchases, etc. Include the balance, interest rate, minimum payment, and due date for each.

2. Create a Detailed Budget

A budget isn’t about restriction; it’s about control. Track where every dollar goes for a month or two. Categorise your spending into needs (rent, food, utilities) and wants (entertainment, dining out). Identify areas where you can cut back to free up more money for debt repayment. Tools from Sorted.org.nz can be incredibly helpful here.

3. Prioritize Your Debts

Two popular strategies for prioritizing debt repayment are:

- Debt Snowball Method: Pay off your smallest debt first, while making minimum payments on others. Once the smallest is paid, take the money you were paying on it and apply it to the next smallest, creating a “snowball” effect. This method is great for psychological wins.

- Debt Avalanche Method: Focus on paying off the debt with the highest interest rate first, while making minimum payments on others. This method saves you the most money in interest over time.

Choose the method that best motivates you and aligns with your financial personality.

4. Stick to Your Plan and Monitor Progress

Consistency is key. Regularly review your budget and debt repayment plan to ensure it’s still working for you. Life happens, so be prepared to make adjustments as needed. Celebrate small victories along the way to stay motivated.

Taking control of your debt is a journey, not a sprint. By leveraging the available free debt advice in South Auckland, understanding your options, and committing to a solid plan, you can confidently work towards a debt-free and financially secure future. Don’t let debt define you; let your commitment to overcoming it empower you.

Frequently Asked Questions (FAQ)

Q: Where can I find free debt advice specifically in South Auckland?

A: You can find free debt advice through local budgeting services accredited by FinCap, Citizens Advice Bureau (CAB), and various community or cultural organizations in South Auckland. Many offer one-on-one financial mentoring to help you manage your debt.

Q: Is debt consolidation a good idea for everyone?

A: Debt consolidation can be beneficial for many, especially if it results in lower interest rates and simplified payments. However, it’s not suitable for everyone. It’s crucial to evaluate the new loan’s terms, avoid accumulating new debt, and assess if it aligns with your long-term financial goals. A financial mentor can help you determine if it’s right for you.

Q: What are the main alternatives to bankruptcy in New Zealand?

A: Alternatives to bankruptcy include debt consolidation, negotiating directly with creditors for revised payment plans or interest reductions, and entering into a Debt Repayment Order (DRO). Seeking advice from a financial mentor before considering bankruptcy is highly recommended.

Q: How long does it take to become debt-free?

A: The time it takes to become debt-free depends entirely on the amount of debt you have, your income, expenses, and the repayment plan you implement. With a solid budget, consistent payments, and potentially cutting back on discretionary spending, many can significantly reduce their debt within a few years.

Q: Can free financial mentors help me negotiate with my creditors?

A: Yes, absolutely. Free financial mentors are highly skilled in debt management and can often provide guidance, strategies, and even act as an advocate on your behalf when negotiating with creditors. They can help you present a realistic repayment proposal.

References & Sources

- Sorted.org.nz – A free service from the Commission for Financial Capability. www.sorted.org.nz

- FinCap (National Building Financial Capability Charitable Trust) – Provides support for financial mentoring services across New Zealand. www.fincap.org.nz

- Citizens Advice Bureau (CAB) New Zealand – Offers free, confidential information and advice. www.cab.org.nz

- Ministry of Business, Innovation & Employment (MBIE) – Information on bankruptcy and insolvency in New Zealand. www.mbie.govt.nz