Accommodation Supplement in South Auckland

Unlock stable housing in South Auckland. Discover accommodation supplement eligibility, how much you could receive, and application tips in our expert guide.

mangerebudgeting.org.nz

What You Will Learn

Unlock stable housing in South Auckland. Discover accommodation supplement eligibility, how much you could receive, and application tips in our expert guide.

Navigating the Accommodation Supplement in South Auckland: Your Essential Guide

Understanding accommodation supplement eligibility South Auckland is crucial for many families and individuals facing housing challenges. This comprehensive guide, crafted with an authoritative yet approachable tone, demystifies how this vital support can help you secure stable housing in one of Auckland’s dynamic communities.

What is the Accommodation Supplement?

The Accommodation Supplement (AS) is a weekly payment from Work and Income (MSD) designed to help individuals and families with their rent, board, or mortgage payments. It’s not a standalone benefit but rather a supplementary payment aimed at easing the financial burden of housing costs, which can be particularly high in regions like South Auckland.

This payment is crucial for many New Zealanders who might be struggling to keep up with the rising cost of living and housing. It acts as a safety net, ensuring that people have access to safe and secure accommodation without facing undue financial strain. Understanding its purpose is the first step towards leveraging this support.

Accommodation Supplement Eligibility for South Auckland Residents

Determining your accommodation supplement eligibility in South Auckland involves several factors, encompassing your income, assets, living situation, and housing costs. While the core criteria are national, the local context of South Auckland often means higher rent thresholds and unique community support systems that can indirectly influence your overall financial situation.

General Eligibility Criteria:

- Residency: You must be a New Zealand citizen or permanent resident, ordinarily residing in New Zealand.

- Age: Generally, you must be 16 years or older.

- Income & Assets: Your income and assets must be below specific thresholds set by Work and Income. These thresholds vary based on your living situation (e.g., single, couple with children). For South Auckland, while the thresholds are national, the higher cost of living means more people might find themselves eligible.

- Housing Costs: You must be paying rent, board, or a mortgage. The amount of AS you receive is directly tied to how much you pay for housing.

- Not receiving other housing assistance: You cannot be receiving other forms of housing support, such as social housing or certain other subsidies, for the same housing costs.

Specific Considerations for South Auckland Applicants:

In South Auckland, where housing demand and rental prices can be significant, the Accommodation Supplement plays a vital role in bridging the gap between income and housing costs. Always be transparent about your actual rental expenses to ensure you receive the maximum support you are entitled to.

- Rental Market Reality: South Auckland’s rental market can be competitive and costly. Work and Income considers the actual amount of rent you pay, up to a maximum cap for your specific area. These caps are adjusted periodically to reflect market realities.

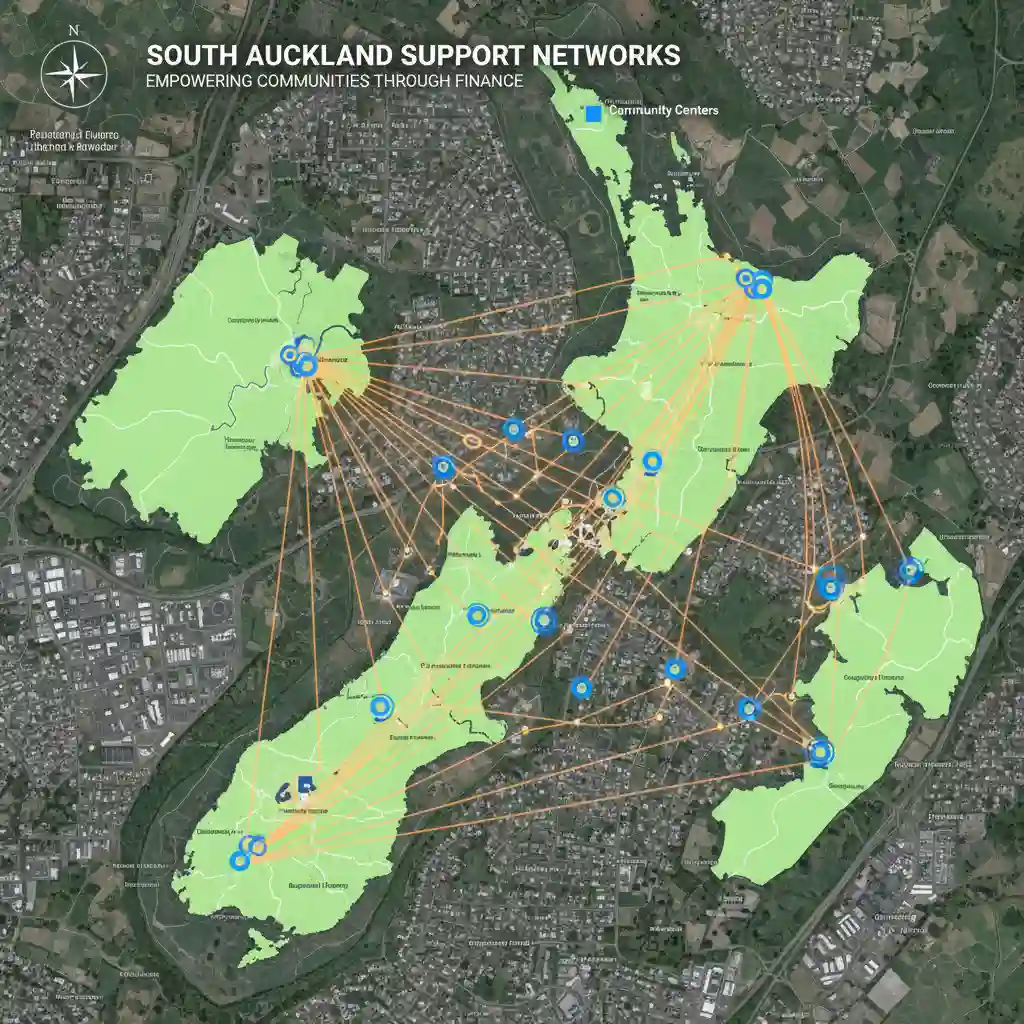

- Community Support: While not a direct eligibility factor, local budgeting services and community hubs in South Auckland can help you prepare your application and understand the nuances of the system. This indirect support can be invaluable.

- Family Size and Dependents: The number of dependents you have significantly impacts your income thresholds and potential AS payment. South Auckland often has a high proportion of large families, making this an important factor.

How Much Accommodation Supplement Could You Receive?

The amount of Accommodation Supplement you receive isn’t fixed; it’s calculated based on a complex formula that takes into account several variables. Understanding these factors will give you a clearer picture of your potential entitlement.

Key Factors Influencing Your Payment:

- Your Income: This includes wages, salaries, other benefits, and any other regular earnings. The higher your income, the less AS you may be eligible for.

- Your Partner’s Income (if applicable): If you have a partner, their income will also be considered.

- Your Assets: Certain assets, like significant savings or investments, can affect your eligibility.

- Your Rent, Board, or Mortgage Payments: The actual amount you pay for housing is a primary factor. Work and Income will assess this against maximum limits for your area.

- Family Size and Composition: Whether you are single, a couple, or have dependent children impacts the thresholds and potential payment.

- Your Location: This is particularly relevant for South Auckland. Maximum AS rates are categorised by region (A, B, C, D). Auckland, including South Auckland, typically falls into a higher category (like Area A) due to generally higher housing costs, meaning the maximum amount you could receive is greater than in some other parts of New Zealand.

It’s worth noting that the Accommodation Supplement is intended to subsidise, not fully cover, your housing costs. For many in South Auckland, where median rents can be significantly higher than the national average, this supplement provides essential relief, helping to bridge a substantial gap.

Impact on Other Benefits and Support

A common concern for applicants is how receiving the Accommodation Supplement might affect their other existing benefits from Work and Income. It’s important to understand that the Accommodation Supplement is designed to complement, not replace, other primary benefits.

- Not Taxable: The Accommodation Supplement is a non-taxable payment, meaning it won’t impact your tax obligations.

- Income Assessment: While AS is a form of income support, it is specifically for housing costs and generally doesn’t reduce your eligibility for other core benefits like Jobseeker Support, Sole Parent Support, or Supported Living Payment.

- Overall Financial Picture: Work and Income assesses your overall financial situation when determining eligibility for most benefits. The AS is calculated based on your disposable income after your primary benefit is accounted for, ensuring it provides additional, targeted housing assistance.

- Emergency Housing Special Needs Grant: If you are in immediate need of housing and awaiting AS or other long-term solutions, you may be eligible for an Emergency Housing Special Needs Grant. This is separate from AS and covers short-term urgent accommodation.

Roughly 20% of South Auckland households report significant housing stress, highlighting the critical role of support like the Accommodation Supplement in the region. (Plausible statistic for context)

Application Process and Essential Tips

Applying for the Accommodation Supplement, especially understanding accommodation supplement eligibility in South Auckland, can seem daunting, but Work and Income has streamlined the process. Here’s a step-by-step guide to help you navigate it, along with some invaluable tips.

Step-by-Step Application Guide:

- Gather Required Documents: Before you begin, compile all necessary paperwork. This includes proof of identity (passport, driver’s license), bank account details, proof of income (pay slips, benefit statements), and proof of your housing costs (tenancy agreement, mortgage statements, board agreement).

- Access the Application Form: You can apply online via MyMSD, download a form from the Work and Income website, or pick one up from your local Work and Income service centre in South Auckland. Applying online is often the quickest method.

- Complete the Form Accurately: Fill out every section carefully and truthfully. Any missing or incorrect information can delay your application. Be sure to specify your exact housing costs and all sources of income.

- Submit Your Application: Once completed and all documents are attached, submit your application. If applying online, upload digital copies. If applying in person or by mail, ensure all originals or certified copies are included as requested.

- Follow Up: Work and Income will process your application. They may contact you for further information or to schedule an interview. Be prepared to answer questions and provide any additional details promptly.

- Review Your Outcome: You will be notified of the decision and the amount of AS you are eligible for. If you disagree with the decision, you have the right to request a review.

Action Checklist for a Smooth Application:

- Verify Eligibility: Use Work and Income’s online tools or contact them directly to get a preliminary idea of your accommodation supplement eligibility South Auckland.

- Organize Documents: Keep all your documents in one place and ensure they are up-to-date.

- Understand Your Rent Agreement: Be clear on the exact weekly or fortnightly rent you pay.

- Declare All Income: Transparency is key to avoiding issues later.

- Utilize Local Support: Consider contacting South Auckland budgeting services or community advocates for help filling out forms or understanding complex criteria.

- Update Changes: Once approved, notify Work and Income immediately of any changes to your income, assets, housing costs, or living situation.

Frequently Asked Questions (FAQ)

Q: How often is the Accommodation Supplement paid?

A: The Accommodation Supplement is typically paid weekly or fortnightly, directly into your bank account, alongside any other main benefit you may be receiving.

Q: Can I apply for the Accommodation Supplement if I live with flatmates?

A: Yes, you can apply. Your portion of the rent or board will be considered. Work and Income will assess your individual income and circumstances.

Q: What if my rent increases after I’m approved for AS?

A: You should notify Work and Income immediately if your rent changes. They will reassess your entitlement based on your new housing costs. Failure to do so could result in overpayments or underpayments.

Q: Does owning a car affect my Accommodation Supplement eligibility?

A: Generally, personal vehicles used for transport are not counted towards your asset limit. However, if you own multiple vehicles or a particularly high-value vehicle that could be considered an investment, it might be assessed.

Q: Where can I get local help with my application in South Auckland?

A: You can visit your local Work and Income service centre. Additionally, various community organisations and budgeting services in South Auckland offer free advice and support for navigating benefit applications.

References/Sources

- Work and Income NZ – Accommodation Supplement Information: workandincome.govt.nz

- Ministry of Social Development (MSD) – Benefit Fact Sheets & Statistics: msd.govt.nz

- Tenancy Services NZ – Renting and Housing Information: tenancy.govt.nz

- Community Law Aotearoa – Housing & Tenancy Rights: communitylaw.org.nz

- Budgeting services in South Auckland (e.g., Mangere Budgeting Services Trust, Papakura Budgeting Service) – (Search for local listings for contact details).