Winz Hardship Assistance Application

Facing urgent costs? Our guide helps you navigate the WINZ hardship assistance application process in NZ, offering clear steps & support for financial resilience.

mangerebudgeting.org.nz

What You Will Learn

Facing urgent costs? Our guide helps you navigate the WINZ hardship assistance application process in NZ, offering clear steps & support for financial resilience.

Navigating the WINZ Hardship Assistance Application: Your Guide to Financial Resilience

Facing unexpected financial challenges can be incredibly stressful, especially when you’re striving to maintain stability for yourself and your family. In South Auckland, many individuals and whānau find themselves in situations where they need urgent support. That’s where Work and Income (WINZ) Hardship Assistance comes in. This comprehensive guide from Mangere Budgeting Services is designed to demystify the WINZ hardship assistance application process, offering clear, actionable steps and expert advice to help you access the support you need.

We understand that asking for help can be daunting, but remember, these services are there for you. Our goal is to empower you with the knowledge to confidently apply for assistance, easing your burden and paving the way towards greater financial resilience. Let’s break down everything you need to know.

Table of Contents

- What is WINZ Hardship Assistance?

- Who is Eligible for Hardship Assistance?

- Types of Hardship Assistance Available

- How to Apply for WINZ Hardship Assistance: A Step-by-Step Guide

- Key Benefits of Hardship Assistance

- Your Hardship Assistance Application Checklist

- Conclusion: Taking Control of Your Financial Future

- Frequently Asked Questions (FAQ)

- References & Sources

What is WINZ Hardship Assistance Application?

The WINZ hardship assistance application is your pathway to receiving urgent financial support from Work and Income, a service of the Ministry of Social Development (MSD). This assistance is not a regular benefit; rather, it’s designed for people who are in a temporary crisis and cannot meet essential living costs. It’s for those times when an unexpected bill, a sudden emergency, or a period of acute financial strain makes it impossible to cover basic necessities like food, rent, or utility bills.

Hardship assistance can provide a crucial lifeline, preventing situations from escalating into more severe crises. It acknowledges that life can throw unexpected curveballs and provides a safety net for New Zealanders when they need it most. Understanding this process is key to getting back on your feet.

Who is Eligible for Hardship Assistance?

Eligibility for WINZ hardship assistance depends on your specific circumstances. Generally, you need to be in a situation where you cannot meet your essential living costs and have explored all other options. This could include:

- You’re already receiving a WINZ benefit but have unexpected costs.

- You’re working but your income is low, and you have an urgent expense you can’t cover.

- You’re experiencing a crisis, such as a natural disaster, family violence, or a sudden illness.

- You have few or no accessible assets or savings.

WINZ will assess your income, assets, and liabilities to determine your eligibility. It’s important to be honest and provide all requested information to ensure a smooth application process.

Types of Hardship Assistance Available

There are various forms of hardship assistance designed to address different urgent needs. These are often non-recoverable grants, meaning you don’t have to pay them back, but some might be recoverable (loans) depending on the type and your situation.

- Emergency Food Grants: For immediate food needs when you have no money left.

- Assistance with Accommodation Costs: Help with rent arrears, bond, or moving costs.

- Essential Services Assistance: Support for power, gas, or water bills to prevent disconnection.

- Special Needs Grants: For a wide range of essential costs that cannot be met in any other way, such as medical expenses, unexpected household repairs, or funeral costs.

- Recoverable Assistance: Loans for larger one-off costs that you can pay back over time.

Each type of assistance has specific criteria. When you apply, WINZ will help determine which type best suits your situation.

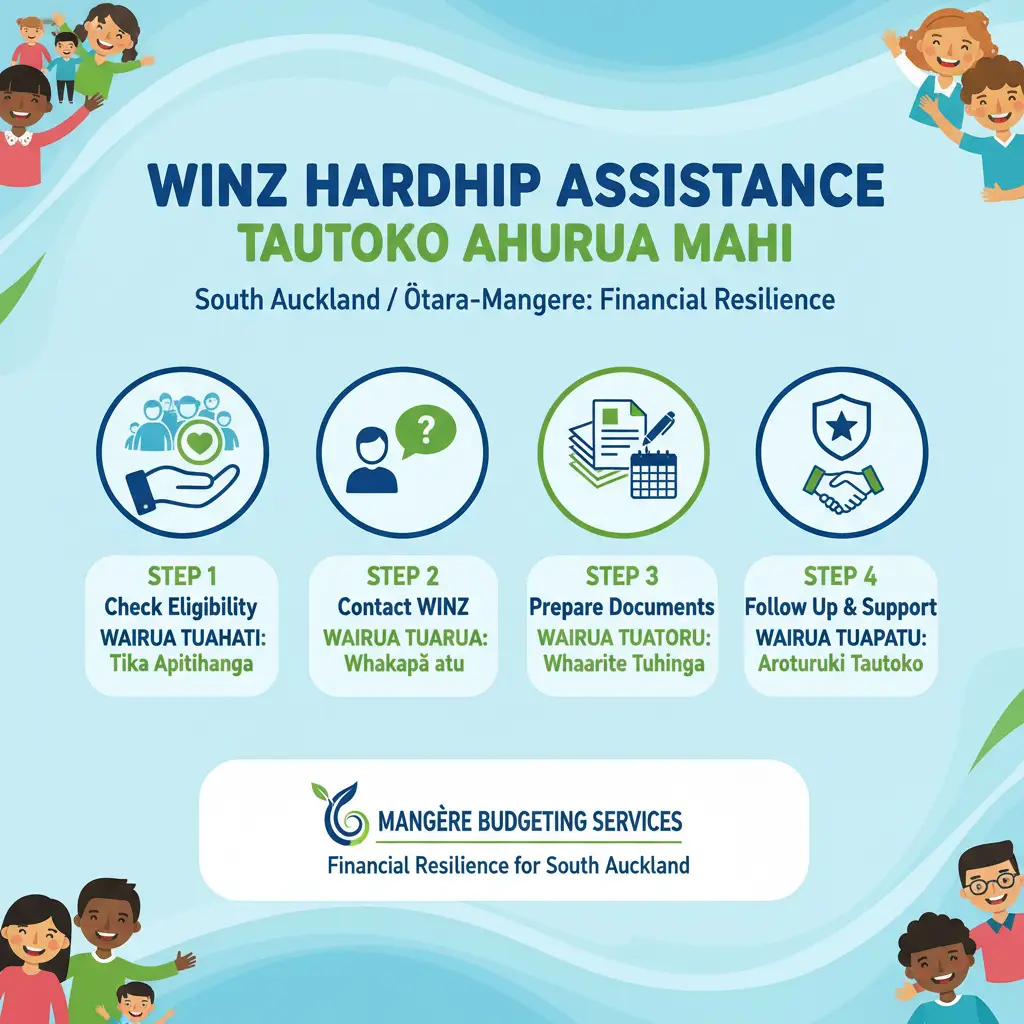

How to Apply for WINZ Hardship Assistance: A Step-by-Step Guide

Applying for the WINZ hardship assistance application can seem complicated, but breaking it down into manageable steps makes it much easier. Follow this guide carefully:

1. Gather Your Information and Documents

- Identification: Your IRD number, driver’s license, passport, or birth certificate.

- Financial Records: Bank statements (usually for the last 90 days) for all accounts, proof of any income (pay slips, benefit statements), details of any assets or savings.

- Proof of Costs: Bills or invoices for the urgent expense you need help with (e.g., overdue rent notice, power bill, medical invoice).

- Accommodation Details: Tenancy agreement if applicable.

2. Contact Work and Income

- Phone: Call WINZ directly to discuss your situation. This is often the quickest way to initiate a hardship application. Their contact centre staff can guide you on the next steps and make an appointment if needed.

- Online: You can start some applications or submit documents via MyMSD, but for urgent hardship assistance, a phone call or in-person visit is usually recommended.

- In-Person: Visit your local WINZ office. In South Auckland, there are several offices where you can speak to a case manager. This can be beneficial for complex situations or if you need immediate assistance.

3. Explain Your Situation Clearly

- Be prepared to explain why you cannot meet your essential costs and what the specific urgent need is.

- Provide dates, amounts, and any relevant details about your situation.

- Highlight if you’ve explored other options (e.g., asked family for help, negotiated with creditors).

4. Attend Your Appointment (If Scheduled)

- If you have an appointment, bring all your documents and arrive on time.

- A case manager will review your situation, assess your eligibility, and discuss the types of assistance available.

- They may ask further questions to understand your financial circumstances thoroughly.

5. Follow Up and Cooperate

- If WINZ requests additional information, provide it promptly.

- Cooperate fully with your case manager. They are there to help you.

- Be patient; while some urgent applications can be processed quickly, others may take a few days.

Expert Tip from Mangere Budgeting Services: If you feel overwhelmed or unsure at any stage, don’t hesitate to reach out to us. We can help you prepare your documents, practice explaining your situation, and even advocate on your behalf with WINZ. Our team is here to support South Auckland whānau through challenging times.

Key Benefits of Hardship Assistance

Securing hardship assistance offers more than just financial relief; it provides crucial benefits that contribute to overall well-being and stability:

- Immediate Financial Relief: The most direct benefit is the immediate injection of funds to cover essential, urgent costs, preventing debt accumulation or further financial hardship.

- Reduced Stress and Anxiety: Knowing that urgent needs are met can significantly reduce the mental burden and stress associated with financial instability.

- Prevention of Crisis Escalation: Hardship assistance can stop a small problem (like an overdue power bill) from becoming a major crisis (like power disconnection and debt collection).

- Opportunity for Stability: By addressing immediate needs, it creates a breathing space to focus on long-term financial planning and resilience strategies.

- Access to Further Support: Engaging with WINZ for hardship assistance often opens doors to other forms of support, such as budgeting advice, employment services, or ongoing benefits if your situation requires it.

“In 2022, over 800,000 Special Needs Grants were issued by WINZ, demonstrating the widespread need for and impact of this vital assistance. This highlights how many New Zealanders rely on this support during difficult times.” — Based on MSD Annual Reports

Your Hardship Assistance Application Checklist

Before you contact WINZ, use this checklist to ensure you’re fully prepared. This will streamline your WINZ hardship assistance application process and increase your chances of a positive outcome.

Ticking off these items will put you in a strong position when you engage with Work and Income.

Conclusion: Taking Control of Your Financial Future

Navigating financial hardship is never easy, but remember that you don’t have to face it alone. The WINZ hardship assistance application process, while requiring careful preparation, is a vital resource designed to provide a safety net when you need it most. By understanding the eligibility criteria, the types of assistance available, and following our step-by-step guide and checklist, you can approach the process with confidence.

At Mangere Budgeting Services, we are committed to supporting our South Auckland community towards financial resilience. If you are struggling, please reach out. We offer free, confidential advice and practical support to help you manage your money, prepare for WINZ applications, and build a more secure future. Taking that first step is often the hardest, but it’s also the most empowering. Kia kaha – stay strong, help is available.

Frequently Asked Questions (FAQ)

Q: How quickly can I get WINZ hardship assistance?

A: For very urgent needs like food or immediate shelter, WINZ aims to process applications as quickly as possible, sometimes on the same day. For less immediate but still urgent needs, it might take a few days. The speed depends on the completeness of your application and how busy the office is.

Q: Do I have to pay back hardship assistance?

A: It depends on the type of assistance. Many forms of hardship assistance, especially Special Needs Grants for essential costs, are non-recoverable (grants) and do not need to be paid back. However, some assistance, like recoverable assistance, is given as a loan and will need to be repaid. Your case manager will clarify this during your application.

Q: Can I apply for hardship assistance if I’m working full-time?

A: Yes, you can. Hardship assistance is not solely for those on benefits. If your income is low and you cannot meet an urgent, essential cost, you may still be eligible. WINZ will assess your income and assets against your essential expenses to determine your need.

Q: What if my application is declined?

A: If your application for WINZ hardship assistance is declined, you have the right to ask for a review of the decision. You can request a reassessment by a different case manager or a formal review by a Benefits Review Committee. Mangere Budgeting Services can help you understand why your application was declined and assist you with the review process.

Q: Can Mangere Budgeting Services help me with my WINZ application?

A: Absolutely! We offer free, confidential budgeting and financial advice. We can help you gather documents, understand the application process, and even act as an advocate for you with Work and Income. Our goal is to make the process as smooth and stress-free as possible for South Auckland whānau.

References & Sources

- Work and Income New Zealand (WINZ) Official Website. (www.workandincome.govt.nz) – For detailed information on hardship assistance and other benefits.

- Ministry of Social Development (MSD) Annual Reports. (www.msd.govt.nz) – For statistical data on assistance provided.

- Community Law Aotearoa. (communitylaw.org.nz) – For independent legal advice and information on social welfare rights.

- Mangere Budgeting Services Trust. (www.mangerebudgeting.org.nz) – For local support, advocacy, and financial capability programmes.