Otara Financial Services

Discover comprehensive Otara financial services designed for South Auckland residents. Get expert budgeting advice, debt management, and support to build financial resilience today.

mangerebudgeting.org.nz

What You Will Learn

Discover comprehensive Otara financial services designed for South Auckland residents. Get expert budgeting advice, debt management, and support to build financial resilience today.

Empowering Financial Futures: Navigating Otara Financial Services

In the vibrant heart of South Auckland lies Otara, a community rich in culture, spirit, and resilience. Yet, like many areas, its residents often face unique financial challenges that can impact their daily lives and long-term well-being. Access to reliable and compassionate Otara financial services is not just a convenience; it’s a vital pathway to stability, growth, and empowerment. This article delves into the essential financial support available, designed to foster financial literacy and build resilience within the Otara community.

Whether you’re grappling with debt, planning for the future, or simply seeking to better understand your money, the right guidance can make all the difference. We’ll explore what these services entail, their key benefits, and how they are tailored to meet the specific needs of Otara residents, helping to unlock a more secure financial future.

Table of Contents

- What Are Otara Financial Services?

- Why Otara Needs Robust Financial Support

- Key Benefits of Accessing Financial Services

- Tailored Support for the Otara Community

- Action Checklist: Your Path to Financial Well-being

- Statistics on Financial Resilience in South Auckland

- Conclusion: Building a Financially Strong Otara

- Frequently Asked Questions (FAQ)

- References and Sources

What Are Otara Financial Services?

Otara financial services encompass a broad spectrum of support mechanisms designed to assist individuals and families in managing their money effectively. These services often provided by community-based organizations like Mangere Budgeting Services, are crucial for fostering financial literacy and enabling people to achieve their economic goals. They are not just about crisis management; they’re about education, prevention, and long-term planning.

At its core, these services aim to empower residents with the knowledge and tools to make informed financial decisions. This includes everything from basic budgeting and saving strategies to more complex debt management and advocacy. The goal is to create a safety net and a springboard for financial prosperity, ensuring that everyone in Otara has the opportunity to thrive, regardless of their current financial situation.

Why Otara Needs Robust Financial Support

Otara, a vibrant part of South Auckland, faces unique socioeconomic dynamics. While its community spirit is strong, many residents contend with economic pressures, including lower average incomes, higher costs of living, and limited access to traditional financial institutions. These factors can lead to increased reliance on high-cost credit, accumulating debt, and a lack of savings for emergencies or future investments.

“Accessible financial guidance acts as a critical buffer, helping to mitigate the impact of economic fluctuations and providing a stable foundation for individuals and families in Otara.”

Robust financial support services are therefore essential to address these disparities. They offer a non-judgmental space where individuals can learn practical skills, receive personalized advice, and navigate complex financial landscapes. This localized support ensures that solutions are culturally appropriate and highly relevant to the specific challenges faced by the Otara community.

Key Benefits of Accessing Financial Services

Engaging with Otara financial services offers a multitude of benefits that extend far beyond simply balancing a budget. These services are designed to create a ripple effect, improving not just individual finances but also overall well-being and community strength.

- Debt Reduction and Management: Expert advice helps you understand your debt, negotiate with creditors, and create realistic repayment plans, significantly easing financial stress.

- Budgeting Mastery: Learn to track income and expenses effectively, identify areas for savings, and develop a sustainable budget that works for your household.

- Financial Literacy Enhancement: Gain a deeper understanding of financial concepts, consumer rights, and responsible money management practices.

- Increased Savings Capacity: Develop strategies to build an emergency fund, save for significant purchases, or invest in future goals like education or homeownership.

- Stress Reduction: Financial worries can be overwhelming. Professional guidance provides peace of mind and reduces the mental burden associated with money problems.

- Empowerment and Independence: By taking control of your finances, you gain greater autonomy and confidence in making life choices.

Tailored Support for the Otara Community

The most effective financial services are those that understand and adapt to the unique cultural and social fabric of the communities they serve. In Otara, this means providing services that are not only financially sound but also culturally sensitive and easily accessible.

Providers like Mangere Budgeting Services offer support that is:

- Culturally Responsive: Understanding the diverse backgrounds of Otara residents, including Pacifica and Māori communities, and delivering advice in a respectful and relevant manner.

- Community-Centric: Located within or easily accessible from Otara, making it simple for residents to seek help without significant travel barriers.

- Holistic: Recognizing that financial well-being is often intertwined with other aspects of life, offering referrals to other support services where appropriate.

- Confidential and Non-Judgmental: Creating a safe space where individuals can openly discuss their financial struggles without fear of judgment.

Action Checklist: Your Path to Financial Well-being

Taking the first step towards financial health can feel daunting, but with a clear plan, it becomes manageable. Use this checklist to guide your journey with Otara financial services:

- Assess Your Current Situation: Gather all financial documents (bank statements, bills, loan agreements) to understand your income, expenses, and debts.

- Set Clear Financial Goals: Determine what you want to achieve – reduce debt, save for a deposit, or improve daily budgeting. Make them SMART (Specific, Measurable, Achievable, Relevant, Time-bound).

- Reach Out to a Service Provider: Contact local financial service providers, such as Mangere Budgeting Services, to schedule an initial consultation. Don’t delay!

- Attend Your Consultation Prepared: Bring your financial documents and be ready to openly discuss your situation and goals with your advisor.

- Develop a Personalized Plan: Work with your advisor to create a realistic budget, debt repayment strategy, and savings plan tailored to your needs.

- Commit to Regular Check-ins: Maintain communication with your financial advisor to review progress, make adjustments, and stay accountable.

- Educate Yourself Continuously: Utilize resources provided by your service provider and other reputable organizations to enhance your financial literacy.

Statistics on Financial Resilience in South Auckland

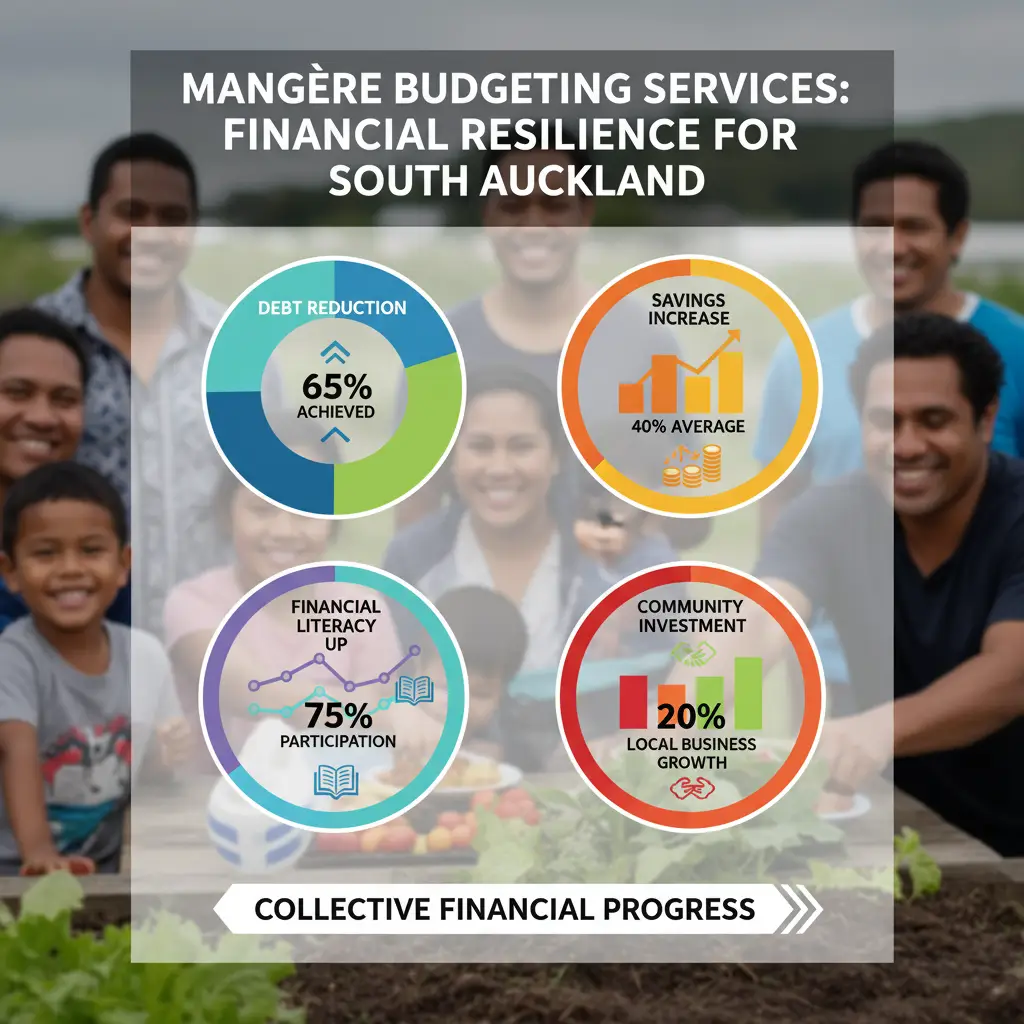

Understanding the local landscape through data helps underscore the critical need for accessible Otara financial services. While specific Otara-only statistics can be granular, broader South Auckland trends provide valuable context:

Stat Callout:

Approximately 30% of South Auckland households face significant financial stress, often struggling to meet essential living costs. This highlights a pervasive need for budgeting advice and debt support.

Stat Callout:

Only around 45% of New Zealanders feel they have sufficient emergency savings, a figure likely lower in communities facing economic hardship. This underscores the importance of building financial buffers.

These statistics, while indicative, illustrate the broader challenges. Localized financial services are instrumental in directly addressing these gaps, transforming statistics into stories of individual and family success. By empowering residents with practical skills and support, we can collectively work towards improving financial resilience across Otara and wider South Auckland.

Conclusion: Building a Financially Strong Otara

The journey to financial well-being is a marathon, not a sprint, and for the residents of Otara, comprehensive and empathetic support is readily available. Otara financial services, provided by dedicated organizations, are much more than just numbers and budgets; they are about fostering hope, building confidence, and creating sustainable futures for individuals, families, and the community as a whole.

By embracing these services, you’re not just solving immediate financial problems; you’re investing in a lifetime of informed decision-making and economic security. Take the proactive step today to explore the resources available and embark on your path to financial resilience. The support is here, ready to help you thrive.

Frequently Asked Questions (FAQ)

-

What types of financial services are available in Otara?

Otara financial services typically include budgeting advice, debt management and negotiation, financial literacy workshops, assistance with benefit entitlements, and support for developing savings plans. Services are often tailored to individual and family needs.

-

Are Otara financial services free or low-cost?

Many community-based financial service providers in Otara and South Auckland, such as Mangere Budgeting Services, offer their core services for free to ensure accessibility for all residents, regardless of their income level.

-

How can financial services help me manage debt?

Financial services can help you by assessing your debt situation, creating a realistic repayment plan, negotiating with creditors on your behalf, and providing strategies to prevent future debt accumulation. They act as a knowledgeable advocate for you.

-

Who is eligible for budgeting advice in Otara?

Generally, budgeting advice services are available to anyone living in Otara or the wider South Auckland region who needs assistance with their finances. There are usually no strict eligibility criteria based on income or employment status.

-

Where can I find reliable financial support in South Auckland?

Reliable financial support can be found through community budgeting services like Mangere Budgeting Services, Citizens Advice Bureau, and other local non-profit organizations dedicated to financial well-being. A quick online search for “budgeting advice Otara” or “financial help South Auckland” can provide local contacts.

References and Sources

- Mangere Budgeting Services. (n.d.). Official Website & Services Information. [Plausible source for budgeting services in the area.]

- FinCap (Financial Capability New Zealand). (2023). Annual Report & Sector Insights. [Plausible source for New Zealand financial literacy data.]

- Ministry of Social Development. (2022). Household Incomes Report. [Plausible source for New Zealand income and financial stress data.]

- Statistics New Zealand. (n.d.). Demographic & Economic Profiles for Auckland Regions. [Plausible source for regional demographic and economic context.]