Papatoetoe Debt Advice

Struggling with debt in Papatoetoe? Get expert, free, and confidential Papatoetoe debt advice. Learn how to manage your finances and achieve financial freedom.

mangerebudgeting.org.nz

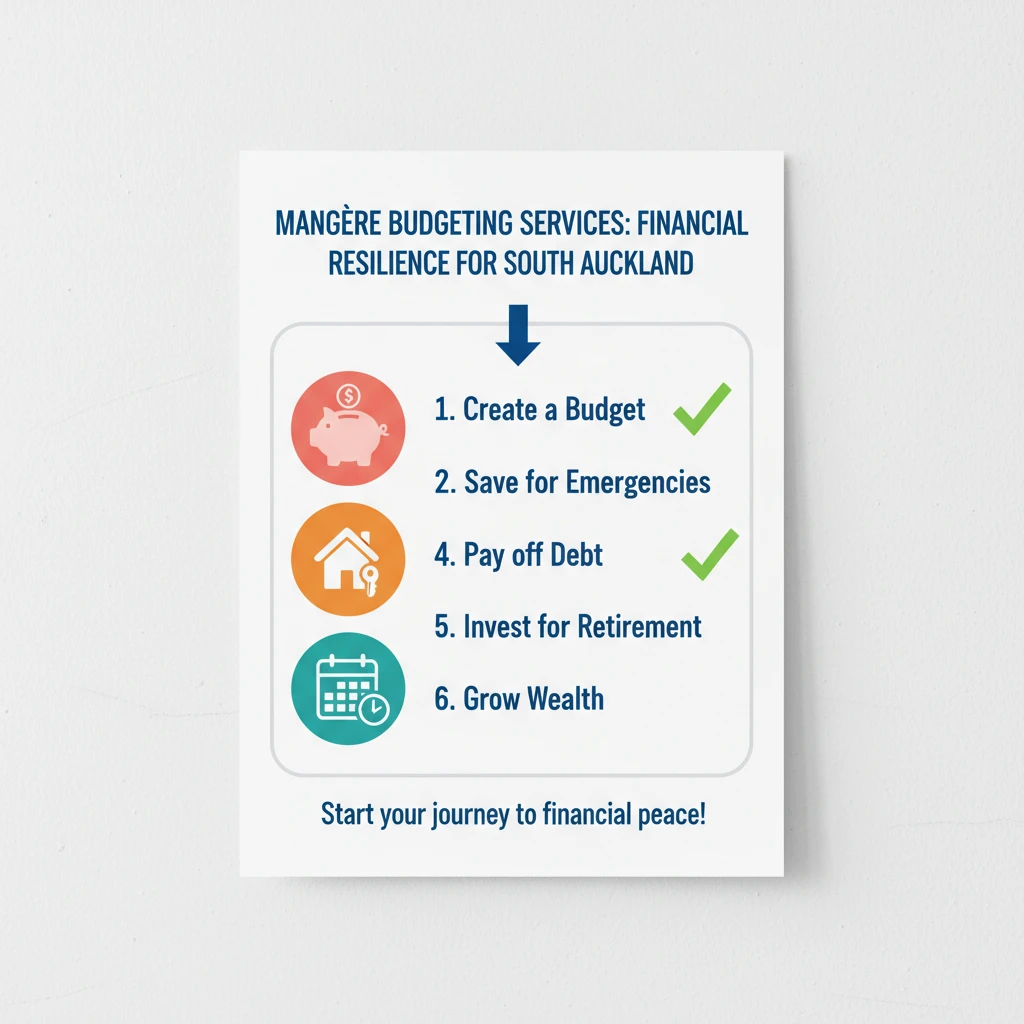

What You Will Learn

Struggling with debt in Papatoetoe? Get expert, free, and confidential Papatoetoe debt advice. Learn how to manage your finances and achieve financial freedom.

Navigating Financial Challenges: Your Guide to Papatoetoe Debt Advice

Facing debt can feel like an isolating and overwhelming battle, especially when the demands of daily life in a vibrant community like Papatoetoe add to the pressure. Whether it’s unexpected bills, rising living costs, or simply trying to make ends meet, financial stress impacts many households. The good news is, you don’t have to face it alone. There’s expert, approachable, and confidential Papatoetoe debt advice available right here in South Auckland, designed to help you regain control and build a path to financial resilience.

This comprehensive guide will explore what effective debt advice entails, highlight the key benefits of seeking local support, and provide actionable steps to help Papatoetoe residents navigate their financial challenges. Our aim is to empower you with the knowledge and tools needed to overcome debt and secure a more stable financial future.

Table of Contents

What is Papatoetoe Debt Advice?

Papatoetoe debt advice refers to the specialised financial guidance and support services offered to individuals and families living in or around Papatoetoe, South Auckland, who are struggling with debt. This isn’t just about telling you to spend less; it’s a holistic approach to understanding your financial situation, identifying the root causes of debt, and developing a personalised strategy for recovery.

Expert advisors provide confidential, non-judgmental support, helping you navigate complex financial jargon and find practical solutions. This can range from creating a sustainable budget and negotiating with creditors to exploring debt consolidation options or insolvency pathways, always with your best interests at heart.

Common Debt Challenges in Papatoetoe

Residents in Papatoetoe, much like many communities in South Auckland, often face unique financial pressures. These can include:

- High Cost of Living: Rent, groceries, and transportation costs can quickly outstrip income.

- Unexpected Expenses: Car repairs, medical emergencies, or job loss can suddenly tip the scales into debt.

- Credit Card Debt: Easy access to credit can lead to accumulating high-interest balances.

- Loan Repayments: Personal loans, car loans, or hire purchase agreements can become unmanageable.

- Utilities and Rent Arrears: Falling behind on essential payments can quickly spiral.

- Lack of Financial Literacy: Not knowing how to budget effectively or manage money can lead to poor financial decisions.

“Seeking local debt advice in Papatoetoe provides a unique advantage: advisors often understand the specific economic landscape and community resources, allowing for more tailored and effective solutions.”

Step-by-Step: How to Get Papatoetoe Debt Advice

Taking the first step is often the hardest, but accessing professional help for your financial situation is simpler than you might think. Here’s a clear pathway to getting the Papatoetoe debt advice you need:

- Acknowledge the Need: Recognise that you need help. There’s no shame in seeking support; it’s a sign of strength and responsibility.

- Gather Your Financial Documents: Before your first appointment, try to collect statements for all debts (credit cards, loans, hire purchases), income details (payslips, benefit statements), and a rough idea of your monthly expenses. Don’t worry if you don’t have everything; advisors can help you piece it together.

- Contact a Local Service: Reach out to a reputable local budgeting and debt advice service in or near Papatoetoe. Organisations like Mangere Budgeting Services offer free, confidential consultations. You can usually call or visit their office to book an appointment.

- Develop a Personalised Plan: Based on your consultation, the advisor will work with you to create a realistic budget, explore options for managing your debts, and set achievable financial goals. This might involve negotiating with creditors, identifying ways to reduce expenses, or exploring government assistance.

- Implement and Monitor: The plan isn’t a one-off event. Your advisor will support you as you implement the strategies. Regular check-ins can help you stay on track, adjust the plan as needed, and celebrate your progress towards financial freedom.

Key Benefits of Local Debt Advice

While generic online advice can be helpful, nothing compares to the targeted support of local Papatoetoe debt advice. The benefits are numerous and significant:

- Understanding of Local Context: Local advisors are intimately familiar with the economic realities, community resources, and challenges specific to Papatoetoe and South Auckland. This allows them to offer more relevant and practical solutions.

- Personalised, Face-to-Face Support: Debt is a personal issue. In-person consultations build trust and allow for a deeper understanding of your unique circumstances, leading to more tailored advice than generic solutions.

- Accessibility and Convenience: Having services located within your community means easier access to appointments and ongoing support without extensive travel, making it simpler to stay engaged with your financial recovery plan.

- Advocacy and Negotiation: Local services often have established relationships with creditors and can advocate on your behalf, helping to negotiate payment plans, interest reductions, or even debt write-offs that you might struggle to secure on your own.

- Empowerment Through Education: Beyond just solving immediate debt problems, local advisors empower you with financial literacy skills. They teach budgeting, saving, and smart spending habits, equipping you for long-term financial stability.

- Community Network and Resources: Being part of a local support network means advisors can connect you with other essential community services, such as employment support, housing assistance, or mental health services, offering a holistic approach to well-being.

Your Action Checklist for Financial Well-Being

Ready to take charge of your financial future? Use this checklist as your guide:

- Review Your Current Financial Situation: List all income, expenses, and debts. Be honest and thorough.

- Contact Mangere Budgeting Services: Schedule a free, confidential appointment for expert Papatoetoe debt advice.

- Attend Your Consultation Prepared: Bring any financial documents you have to make the most of your time with the advisor.

- Commit to Your Budget: Work with your advisor to create a realistic budget and stick to it as closely as possible.

- Explore Debt Management Options: Discuss potential strategies like debt consolidation, payment plans, or hardship applications with your advisor.

- Monitor Your Progress: Regularly review your budget and debt repayment plan. Adjust as needed with your advisor’s help.

- Learn and Grow: Utilise the financial literacy resources provided by your local service to build stronger money management skills.

- Celebrate Small Wins: Acknowledge your progress, no matter how small. Every step forward is a victory on your journey to financial freedom.

Conclusion

Debt can cast a long shadow, but it doesn’t have to define your life. For residents of Papatoetoe, accessible, expert, and empathetic Papatoetoe debt advice is a powerful tool for turning financial struggles into success stories. By taking the proactive step of seeking professional help, you gain not only a pathway out of debt but also the knowledge and confidence to build lasting financial stability.

Remember, the team at Mangere Budgeting Services is here to support you every step of the way. Don’t let financial worries overwhelm you; reach out today and begin your journey towards a brighter financial future.

Frequently Asked Questions (FAQ)

What services does Papatoetoe debt advice offer?

Papatoetoe debt advice services, typically offered by organisations like Mangere Budgeting Services, provide comprehensive support including budgeting assistance, debt management plans, negotiation with creditors, financial education, and guidance on various debt solutions like consolidation or insolvency.

Is Papatoetoe debt advice free and confidential?

Yes, reputable local budgeting services in Papatoetoe, such as Mangere Budgeting Services, offer free and strictly confidential debt advice. Your personal and financial information is kept private, allowing you to discuss your situation openly without fear of judgment.

How quickly can I see results from debt advice?

The timeline for seeing results can vary greatly depending on your individual debt situation, commitment to the plan, and the types of solutions implemented. Some immediate relief might come from creating a realistic budget, while full debt resolution can take months or even years. The key is consistent effort and ongoing support.

Do I need to live directly in Papatoetoe to receive debt advice there?

Typically, services like Mangere Budgeting Services cater to the wider South Auckland region, including Papatoetoe. While being a local resident is often beneficial for in-person support, many services also offer assistance to those in surrounding areas who can access their offices.

What should I bring to my first debt advice appointment?

It’s helpful to bring any documents related to your income (payslips, benefit statements), expenses (utility bills, rent statements), and all outstanding debts (credit card statements, loan agreements, hire purchase contracts). Even if you don’t have everything, the advisor can still start the process with you.

References and Sources

- Mangere Budgeting Services Trust. Official Website: mangerebudgeting.org.nz (Accessed various dates).

- Ministry of Social Development (MSD) New Zealand. Information on Financial Assistance and Budgeting Services: msd.govt.nz (Accessed various dates).

- Financial Capability Commission (Sorted.org.nz). Resources on Debt Management and Budgeting: sorted.org.nz (Accessed various dates).

- Citizens Advice Bureau New Zealand. Advice on Debt and Money: cab.org.nz (Accessed various dates).