Introduction to the 50/30/20 Savings Rule

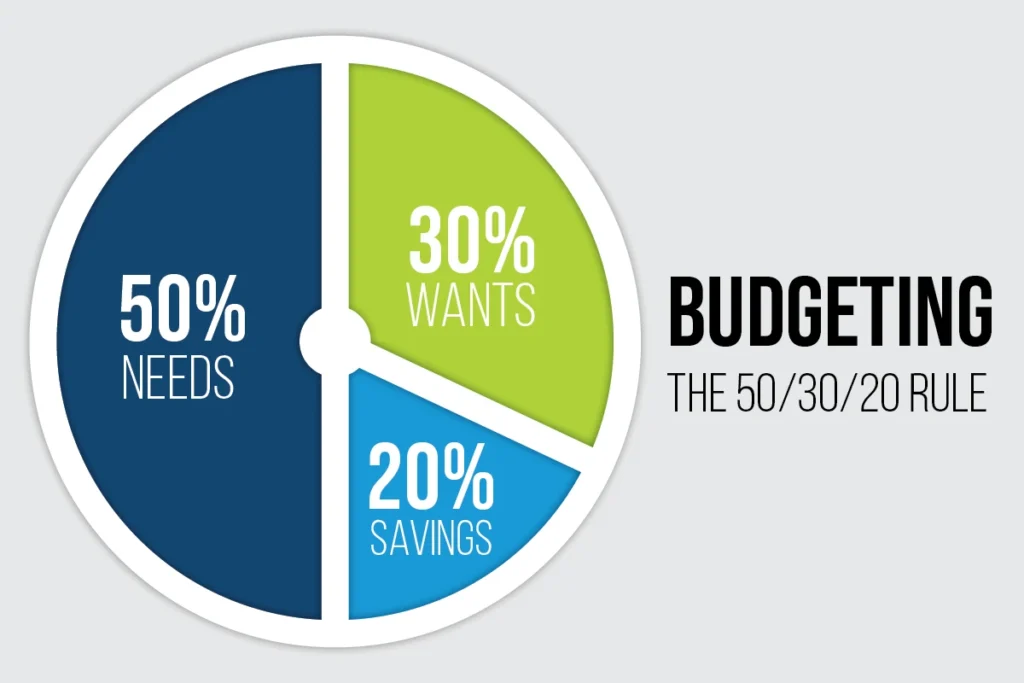

The 50/30/20 savings rule is a simple yet powerful budgeting strategy designed to help you manage finances without overwhelming complexity. By dividing your after-tax income into three primary categories—50% for essential needs, 30% for discretionary wants, and 20% for savings and debt repayment—this rule encourages a balanced financial approach that aligns with both immediate and long-term goals.

The 50/30/20 rule allows you to easily distinguish between essential and non-essential spending. Essentials, like housing and groceries, fall within the 50% category, ensuring stability in meeting basic needs. The 30% portion, reserved for wants, enables you to enjoy your income without overindulging. Lastly, the 20% savings and debt repayment category ensures that you prioritize financial growth and security.

This approach is adaptable and empowers individuals to take control of their finances with a clear, structured plan. The 50/30/20 rule budget is ideal for anyone aiming for financial freedom, whether you’re just seeking budget help or looking for a simple, effective plan.

Breaking Down the 50/30/20 Savings Rule in Detail

The 50/30/20 rule is a flexible framework that allocates your after-tax income across three essential categories to simplify financial planning.

- 50% for Essential Needs:

This portion should cover unavoidable, necessary expenses, often referred to as “needs.” Examples include rent or mortgage payments, utilities, groceries, healthcare, and essential transportation costs. Allocating half of your income here helps ensure that essential bills are consistently paid, creating a stable financial foundation.

- Managing Essentials: Identify and limit overspending in this area by tracking costs. For example, use energy-saving strategies for utilities or budget-conscious meal planning to help stay within the 50% range.

- 30% for Wants:

The wants category is reserved for discretionary expenses that add enjoyment to life. These can include dining out, entertainment, hobbies, travel, and non-essential shopping. While these are not critical expenses, they help you enjoy the flexibility and rewards of budgeting effectively.

- Finding Balance in Wants: Wants can sometimes be the most challenging to manage since they often fluctuate. Consider setting a monthly cap on this category and reviewing spending to prioritize experiences that add the most value to your lifestyle.

- 20% for Savings and Debt Repayment:

This final 20% is dedicated to building financial security through savings or reducing debt. This can mean contributing to an emergency fund, investing in retirement accounts, or paying down existing debt. Prioritizing this category helps in achieving long-term financial goals, from establishing a solid safety net to paving the way for future investments.

- Setting Goals for Savings and Debt: Start with a clear goal, such as saving three to six months’ worth of expenses for emergencies. Then, allocate funds toward reducing high-interest debt or investing in growth opportunities.

Following the 50/30/20 rule budget enables you to address immediate needs, enjoy discretionary spending, and steadily work toward financial security without feeling financially restricted. This structured approach is flexible, allowing adjustments as income or goals change.

50/30/20 Budget Calculator

Ready to take control of your finances? The 50/30/20 savings rule makes budgeting simple by dividing your income into needs, wants, and savings. This calculator lets you easily break down your monthly income to see exactly how much you should allocate to each category.

Try it out now and start building a balanced, stress-free budget!

50/30/20 Budget Calculator

Enter your monthly income to see a suggested budget breakdown.

Benefits of Using the 50/30/20 Savings Rule

The 50/30/20 rule offers several advantages that make it a popular budgeting method:

- Simplicity and Accessibility: This budgeting rule is easy to understand and implement, even for those new to managing finances. It provides a straightforward breakdown that simplifies financial planning.

- Flexibility: Unlike more rigid budgeting methods, the 50/30/20 rule allows you to adjust within each category as needed. It accommodates fluctuations in income and expenses, making it suitable for various financial situations.

- Encourages Balanced Spending: By splitting income into needs, wants, and savings, the rule ensures a healthy balance between essential and discretionary spending, as well as future financial security. This structure can reduce financial stress and promote mindful spending habits.

- Supports Long-Term Financial Goals: Allocating 20% to savings and debt repayment helps create a habit of prioritizing financial growth. This makes it easier to save for future goals, from building an emergency fund to investing for retirement.

- Reduces Debt Reliance: By including debt repayment as part of the 20% savings category, the rule helps you proactively reduce debt over time, which can lead to greater financial freedom and reduced interest payments.

Practical Tips for Following the 50/30/20 Savings Rule

- Track Your Spending: Begin by tracking expenses for one month to see where your money currently goes. This will help you make necessary adjustments to fit the 50/30/20 framework.

- Use Tools and Calculators: Take advantage of 50/30/20 calculators available online to simplify the allocation of your income across categories. This can help keep your budget precise and avoid overspending.

- Reevaluate Regularly: Life changes—such as a new job, relocation, or a family addition—might require adjustments to your budget. Revisit the 50/30/20 rule periodically to ensure it aligns with your current financial goals and circumstances.

- Start Small with Savings: If 20% for savings feels challenging, start with a smaller amount and work up to the full 20%. Consistency is key, and even small amounts can add up over time.

By combining these practical tips with the core 50/30/20 savings rule structure, this rule can be a flexible, long-term solution for anyone looking to simplify their financial management.

Common Challenges and Solutions with the 50/30/20 Rule

While the 50/30/20 savings rule is versatile, some may encounter challenges adapting it to their unique financial situations. Here’s how to tackle common obstacles:

- Irregular Income: Those with fluctuating earnings (e.g., freelancers) can adjust by setting conservative averages for the budget and saving surplus income for leaner months.

- High Cost of Living: In areas with expensive housing or essentials, the 50% needs allocation may not be feasible. In these cases, consider adjusting the ratio temporarily, such as 60/20/20, or finding areas to reduce wants.

- Debt Repayment Pressure: When significant debt needs attention, the 20% savings category might feel insufficient. Prioritize high-interest debts first and consider scaling back on wants temporarily to free up more funds for debt repayment.

- Sticking to the Budget: It can be challenging to stay within these boundaries, especially for wants. Set realistic spending limits and review your budget periodically to make adjustments where needed.

By adapting the rule to fit personal circumstances, individuals can overcome these challenges and make the 50/30/20 budget rule a sustainable part of their financial habits.

Comparing the 50/30/20 Rule to Other Budgeting Methods

While the 50/30/20 rule is effective for many, other budgeting methods may suit different financial situations or preferences. Here are a few popular alternatives:

- Zero-Based Budgeting: Assigns every dollar a purpose, ensuring every expense and saving goal is accounted for.

- Envelope System: Uses physical or digital “envelopes” for each spending category, limiting spending to what’s in each envelope.

- Pay-Yourself-First: Prioritizes savings goals by setting aside savings first, then allocating the remainder for needs and wants.

- 80/20 Rule: A simpler structure where 80% goes to expenses, and 20% is saved.

Each of these approaches has unique benefits, and some may even prefer blending aspects of different methods with the 50/30/20 rule for a personalized budgeting system.

Conclusion: Take Control with the 50/30/20 Rule

The 50/30/20 rule offers a simple, flexible structure to manage your finances effectively, making it suitable for both beginners and experienced budgeters. By balancing essential needs, enjoyable spending, and dedicated savings, you can create a financially secure and fulfilling lifestyle.

If you’re ready to take control of your finances, start by implementing the 50/30/20 rule in small steps. Use budgeting tools or calculators to simplify the process, and adjust as your goals and circumstances evolve. Begin your journey to financial freedom today!